Daily Market Recap 06/30

---------- Foreword ----------

Thanks for cruising by to read. Posted daily, just after the close. If you appreciate the effort, don't forget to rec and bookmark the source; JoshSebastian.BlogSpot.com. Enjoi

I have heard people say, "only two things affect price; fear and greed. " Unfortunately, I have difficulty measuring fear and greed on the yahoo message boards (as if). Instead I prefer fundamentals and sentiment. If you can understand and accept that fundamentals and sentiment can sometimes be pitted directly against one another, you'll have a much easier time recognizing opportunity.

I think some buyers may come out of the woodwork for a short time (Blog Found on caps while writing - "Close to short term bottom? Ready for bottom fishing..."). See? When that second bear rally comes (today?) and runs out of steam...you may be sitting on the precipice of one of the next largest drops in stock market history. Sounds radical huh? Well, that's exactly what happened in June - worst June since depression.

---------- Important Crap ----------

We got a higher open then an immediate drop. (I hope you didn't short into the hole because you would have gotten smacked for 1.5% before leverage.) If we manage to close the day up, I'd look for firming support in the indices till more bad news drifts out.

Oil / Gold / Dollar / S&P - This love triangle got uglier (Chart Below) as the S&P started to trade in lock-step. This should show you that NO ONE knows what is going on and is watching everyone else. There are just more risky and less risky bets out there.

So, we can see that as the dollar gained strength (who knows from where) and oil and gold both came down. Actually though, there has been a lot of upward action in oil and gold. If you remember, on Friday I said

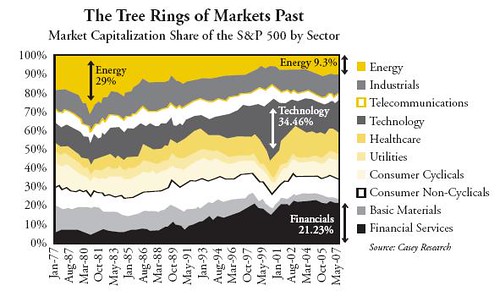

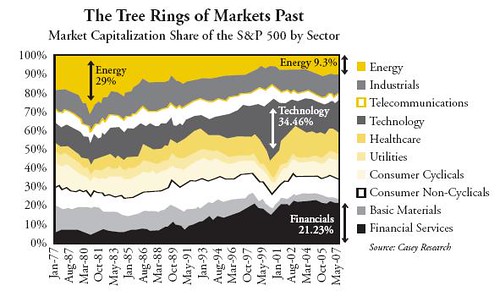

As far as the future...I'm in a "hurry up and wait" mode here guys. We're on the edge of the void and not making any strong progress up. I think tomorrow is the last day to make a firm push up. After that, I say bright red falling candles without good news. Take a look at the chart below. See how big financials have become? We got that good at making money by moving money around? Well...mix inflation and inappropriate risk and I think we have quite a while to fall....just...how fast?

---------- Random Crap ----------

Gone Pro - Well, things finally came to a head with my employer. Not to get too into it, but I was denied a scheduled raise after the date it was supposed to begin. My boss' answer was "Let's talk next quarter." Well...that was today. He did not wish to make the situation right in any way shape or form, despite accepting my labor for the last quarter. So...I packed my desk and rode home. :D So let's watch to see which option would have been the more economically efficient choice for my former employer.

Unfortunately, I think I'm going to have to sue for breach of contract (bummer). Nevertheless, I had been cutting my bills, shifting funds and planning a vacation in preparation. Also because the company (not public) is starting to have cash flow troubles. Yikes!

So long story short, I'm going to try to go "semi-pro" trading and either travel or get a part time till school starts. However, if you know anyone that might be interested in spending some time at my beach apartment in San Diego this summer, talk to me...I'd rather travel.

The Inflation / Deflation discussion - is happening in many places at once. I'm going to add my comments and be done with it, for now.

What if there is a drought while it's raining?

Imagine a global slowdown where commodity prices are decreasing. Furthermore, imagine a country which manages to carve a niche, and keep thriving. Within that country, they decide to increase their monetary base. They decide to INFLATE despite prices falling around them.

The word for that would be....? Deflation by default? Hardly.

But, if inflation can be a global problem, I'd love to hear about how.

The U.S. is in a deflation (with global "price inflation")

This deflation is specific to the U.S.

This deflation is NEW. ("Credit Contraction", "Squeeze", "unwind" - Inflation?)

This U.S. deflation will not cause commodity prices to fall. Unless...

The world follows the U.S. into a slowdown.

Thus...this deflation may have compounding effects for the U.S.

The global slowdown scenario would cause commodity prices to fall.

We would then be in a GLOBAL deflation, but we aren't now.

SOLD TRA 55 CALLS (+~30%, Stopped out, Then TRA fell apart WTF? If no bad market news, this is GREAT buying op. IMHO.)

BOUGHT EWZ 90 CALLS (-9%)

BOUGHT USO 113 PUTS (+8%, Pray to allah for me.)

BOUGHT XLF 20 PUT 01/09 (-3%, OK, I paid for nothing but time here...6 months! Whooo!)

SPY 135 CALLS (-~50%)

I'm also screwing with some covered calls and puts. I'm just not getting into it until I quit experimenting.

Thanks for cruising by to read. Posted daily, just after the close. If you appreciate the effort, don't forget to rec and bookmark the source; JoshSebastian.BlogSpot.com. Enjoi

I have heard people say, "only two things affect price; fear and greed. " Unfortunately, I have difficulty measuring fear and greed on the yahoo message boards (as if). Instead I prefer fundamentals and sentiment. If you can understand and accept that fundamentals and sentiment can sometimes be pitted directly against one another, you'll have a much easier time recognizing opportunity.

I think some buyers may come out of the woodwork for a short time (Blog Found on caps while writing - "Close to short term bottom? Ready for bottom fishing..."). See? When that second bear rally comes (today?) and runs out of steam...you may be sitting on the precipice of one of the next largest drops in stock market history. Sounds radical huh? Well, that's exactly what happened in June - worst June since depression.

---------- Important Crap ----------

We got a higher open then an immediate drop. (I hope you didn't short into the hole because you would have gotten smacked for 1.5% before leverage.) If we manage to close the day up, I'd look for firming support in the indices till more bad news drifts out.

Oil / Gold / Dollar / S&P - This love triangle got uglier (Chart Below) as the S&P started to trade in lock-step. This should show you that NO ONE knows what is going on and is watching everyone else. There are just more risky and less risky bets out there.

So, we can see that as the dollar gained strength (who knows from where) and oil and gold both came down. Actually though, there has been a lot of upward action in oil and gold. If you remember, on Friday I said

"If we have a post correction surge on Monday (maybe Tues), I pity the man caught short.All three happened today. I think gold is ahead of itself, but solid. I have no idea what oil is doing, but looks to be softening. Let's see what our Asian and European cousins think tomorrow at the open. The dollar may go up, but can't go far without news. I'm looking for the dollar to keep bottom fishing indefinitely.

Gold responded appropriately and futures went through the roof (~$930). (I sold off my calls because the move was big and fast.)

Oil futures were rolling over today, then went nuts, now rolling over again? Time to get short oil for a few days? Maybe. We'll have inventory on Tues or Wed i think. "

As far as the future...I'm in a "hurry up and wait" mode here guys. We're on the edge of the void and not making any strong progress up. I think tomorrow is the last day to make a firm push up. After that, I say bright red falling candles without good news. Take a look at the chart below. See how big financials have become? We got that good at making money by moving money around? Well...mix inflation and inappropriate risk and I think we have quite a while to fall....just...how fast?

---------- Random Crap ----------

Gone Pro - Well, things finally came to a head with my employer. Not to get too into it, but I was denied a scheduled raise after the date it was supposed to begin. My boss' answer was "Let's talk next quarter." Well...that was today. He did not wish to make the situation right in any way shape or form, despite accepting my labor for the last quarter. So...I packed my desk and rode home. :D So let's watch to see which option would have been the more economically efficient choice for my former employer.

Unfortunately, I think I'm going to have to sue for breach of contract (bummer). Nevertheless, I had been cutting my bills, shifting funds and planning a vacation in preparation. Also because the company (not public) is starting to have cash flow troubles. Yikes!

So long story short, I'm going to try to go "semi-pro" trading and either travel or get a part time till school starts. However, if you know anyone that might be interested in spending some time at my beach apartment in San Diego this summer, talk to me...I'd rather travel.

The Inflation / Deflation discussion - is happening in many places at once. I'm going to add my comments and be done with it, for now.

What if there is a drought while it's raining?

Imagine a global slowdown where commodity prices are decreasing. Furthermore, imagine a country which manages to carve a niche, and keep thriving. Within that country, they decide to increase their monetary base. They decide to INFLATE despite prices falling around them.

The word for that would be....? Deflation by default? Hardly.

But, if inflation can be a global problem, I'd love to hear about how.

The U.S. is in a deflation (with global "price inflation")

This deflation is specific to the U.S.

This deflation is NEW. ("Credit Contraction", "Squeeze", "unwind" - Inflation?)

This U.S. deflation will not cause commodity prices to fall. Unless...

The world follows the U.S. into a slowdown.

Thus...this deflation may have compounding effects for the U.S.

The global slowdown scenario would cause commodity prices to fall.

We would then be in a GLOBAL deflation, but we aren't now.

SOLD TRA 55 CALLS (+~30%, Stopped out, Then TRA fell apart WTF? If no bad market news, this is GREAT buying op. IMHO.)

BOUGHT EWZ 90 CALLS (-9%)

BOUGHT USO 113 PUTS (+8%, Pray to allah for me.)

BOUGHT XLF 20 PUT 01/09 (-3%, OK, I paid for nothing but time here...6 months! Whooo!)

SPY 135 CALLS (-~50%)

I'm also screwing with some covered calls and puts. I'm just not getting into it until I quit experimenting.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home